The growth of VMware suffered a slow down in Q4 2007, leading the company to miss the financial forecasts. In details:

- Total revenues for the fourth quarter were $412 million, an increase of 80% compared to the year-ago quarter.

- GAAP operating income for the fourth quarter was $76 million compared to $37 million in the fourth quarter of 2006. Non-GAAP operating income was $108 million, representing 26% of fourth-quarter revenues and an increase of 72% over the year-ago quarter.

- GAAP net income for the quarter was $78 million, or $0.19 per diluted share, compared to $31 million, or $0.09 per diluted share, in the year-ago quarter. Non-GAAP net income for the quarter was $103 million, or $0.26 per diluted share. GAAP and non-GAAP net income for the fourth quarter of 2007 include a $0.01 per diluted share benefit from a change in tax rate.

- Total revenues for the full fiscal year 2007 were $1.33 billion, an increase of 88% compared to 2006.

- GAAP operating income for the full fiscal year 2007 was $235 million compared to $121 million in 2006. Non-GAAP operating income for the year was $338 million, representing 26% of full-year revenues and an increase of 77% over 2006.

- GAAP net income for the year was $218 million or $0.61 per diluted share, compared to $86 million, or $0.26 per diluted share, in 2006. Non-GAAP net income was $295 million or $0.82 per diluted share.

Despite these numbers analysts expected a sales report of $417 million and an earnings report (excluding special items) of 24 cents per share.

Several news magazines are reporting different analysis which can be summarized below:

- Missing the revenues one quarter after the IPO is the first sign of fundamental weakness in the business,” said Trip Chowdhry, an analyst with Global Equities Research in San Francisco. “The story is overhyped.” (Bloomberg)

- Trip Chowdhry, managing director at Global Equities Research, said that rivals like Oracle, Microsoft, IBM, and Xen, are taking market share away from VMware.

Chowdhry said that VMware may have one or two more quarters of “okay” revenues before price erosion and market share losses deteriorate its business fundamentals further. (Forbes) - JP Morgan analyst Adam Holt said that license revenue of $284 million was the problem in the quarter. License revenue fell below Holt’s $295 million revenue and the consensus of $292 million. In a nutshell, Holt said VMware had little room for error given its shares were trading at lofty levels. License revenue growth fell to 76 percent from year over year compared to 96 percent from the third quarter. Holt noted that deceleration will raise concerns about demand or a weakening economy. (ZDNet)

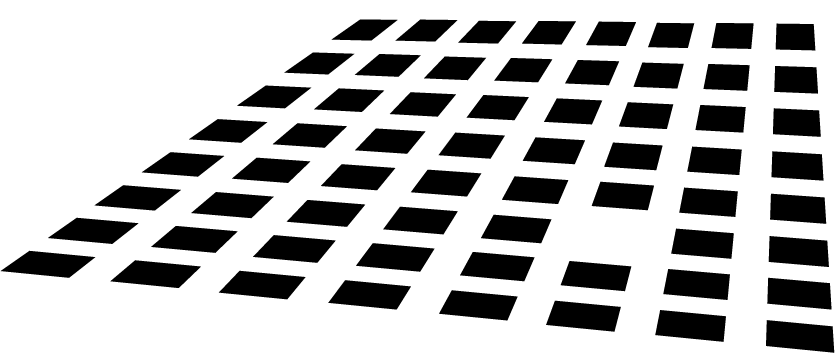

After-hours trading shows how the results negatively impacted investors (-26.83%):